MENU

CLOSE

“Attraverso il teatro io penso tutto il resto: io vedo la politica attraverso il teatro, vedo l'urbanistica”

Paolo Grassi

Paolo Grassi

Nuove esplosioni festival

La Val D'Arda è un'esplosione unica. vieni. vivila con noi.

27/05/2023 - 21:00

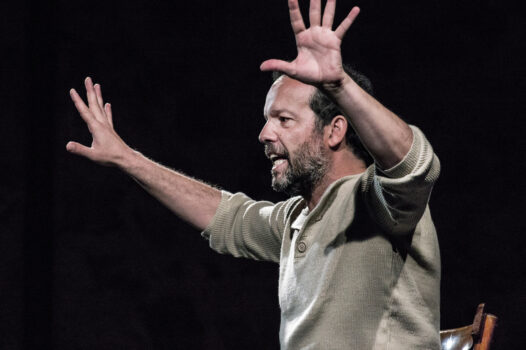

Mario Perrotta | “Italiani Cìncali”

-

Paolo Nani | “La Lettera”

2 Luglio - 19:00

Patanè-Traore

Racconto teatrale sul valore delle differenze, frammento della ricchezza cultura dell’Africa Occidentale raccontato attraverso la parola, la danza, la musica.

2 Luglio - 21:00

Qui e ora residenza teatrale

Il cibo e la tavola accompagnano le nostre vite da sempre, sono indice del nostro benessere e delle nostre relazioni sociali, raccontano i nostri desideri e le nostre paure.

2 Luglio - 20:00

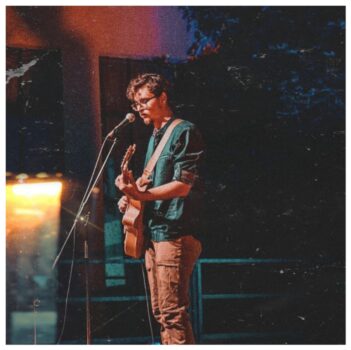

Salvo Giordano in concerto

Salvo Giordano è un autore e musicista, torna quest’anno per raccontare in musica un mondo ricco di piccole storie quotidiane, immagini.

30 Giugno - 20:00

Franco Bernardo in concerto

Franco Bernardi è chitarrista, cantautore e produttore musicale. Nel 2021 auto produce e pubblica i suoi primi inediti "Città Spente" e "Otrera, I'm just a man".

27-29 Giugno - 21:00

Arteinscacco

L’ordine delle cose è una performance itinerante che nasce nel 2019 nell’ambito del progetto “Shake!” promosso da CRV e Comune di Vercelli

30 Giugno - 21:00

Mulino ad arte

Mi abbatto e sono felice è un monologo a impatto ambientale “0”, autoironico, dissacrante, che vuole far riflettere su come si possa essere felici abbattendo l’impatto...

25 Giugno - 21:00

Moby Dick del Teatro dei Venti

Moby Dick è uno spettacolo-evento ideato per i grandi spazi urbani, che porta in piazza la nave del capitano Achab e la sua ossessione per la Balena bianca, con...

03 Luglio - 21:00

Giuseppe Cederna

Dalle rive dell’Isonzo di Giuseppe Ungaretti, alle sorgenti del Gange tra le montagne dell’Himalaya, fino alle coste e alle isole del Mediterraneo, avventure, naufragi, derive....

19 Giugno - 21:00

Roberto Mercadini & Guido Catalano

Due schegge impazzite percorrono ciascuna la sua imprevedibile traiettoria, ma possono pur sempre incrociarsi. Due cani sciolti che non hanno padroni né un branco; ma possono...

Progetti

Dai progetti per il programma Erasmus Plus ad Europa Creativa, fino all'Atobus a due piani dell'Utopia Possibile: tutti i prodotti del laboratorio creativo di Sciara Progetti Teatro

Spettacoli

Dalla Trilogia dell'Amore Negato, agli spettacoli di Teatro Ragazzi, fino ai racconti-verità di Ture Magro: tutte le produzioni di Sciara Progetti Teatro

Pinocchio in Lockdown

Obic Super Spar

Cosa c'è nel tuo piatto?

Mi Costituisco

Il giullare è tutto questo e altro ancora

Mi consumo ergo sum

Consumo perché sono triste e sono solo

Padroni delle nostre vite

Ben fatto, ben scritto, ben recitato. E' agghiacciante, deve andare ovunque. (Lina Wertműller)

Uno sguardo sbagliato

Dal progetto Utopia Possibile, una coproduzione Sciara Progetti, Comune di Poirino e Coop. Sociale Mirafiori

Uno strappo

Bisogna chiamare le cose con il loro nome.

Bestia

La violenza è l'ultimo rifugio degli incapaci.

Malanova

Quel teatro che ti incolla alla sedia, ti toglie il fiato, ti arriccia il cuore e lo stomaco. (Cristina Zagaria)

Workshops

Corsi, laboratori, percorsi di sperimentazione tra arte e didattica: la formazione proposta da Sciara Progetti Teatro

Workshop

100+1 Workshop

Workshop

Sezione TOOLS & EXPERIENCE

Sezione Tools & Experience. Tre workshop in programma per IDEAS FOR A CREATIVE YOUNG EUROPE - II Ed.

Workshop

Europa Creativa

Europa Creativa: Istruzioni per l'uso. Workshop in programma per IDEAS FOR A CREATIVE YOUNG EUROPE II-Ed.

Workshop

Cultura: i finanziamenti europei

Cultura: i finanziamenti europei. Webinar in programma per IDEAS FOR A CREATIVE YOUNG EUROPE II-Ed.

Workshop

Dall’Idea al Progetto

Dall'Idea al Progetto. Workshop in programma per IDEAS FOR A CREATIVE YOUNG EUROPE II-Ed.

Chi siamo

Ture Magro, Emilia Mangano, Sonia Monticelli e Antonio Di Vito: il team artistico ed organizzativo di Sciara Progetti Teatro